The insurance industry is stepping into the digital world with a host of new automation and tools to make claims handling and processing easier for agents and consumers. Large corporations and small businesses alike are starting to see the value in automating certain processes to speed up timelines and provide better customer service.

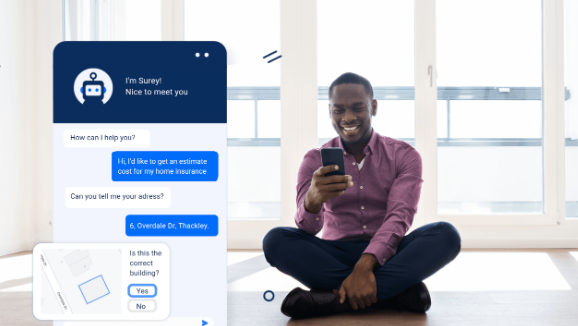

One of these methods is using chatbots as part of their customer service teams. Utilizing this form of AI can help an insurance company better manage client relations in a number of different ways. Let’s take a look at a few of them.

1. Customer Engagement

When people come to an insurance company, they inevitably have a lot of questions. In fact, the beginning of a relationship with their agent might be just asking questions and receiving routine information about policies. Chatbots can help streamline this process and save your agents time by answering the questions first.

Installing a chatbot on your website with dynamic question-and-answer capabilities allows you to meet customer needs even before they talk to a salesperson. It also helps potential customers qualify themselves before requesting a sales call. This means when someone does make it to your salesperson, they’re educated about your services and know they qualify for a policy.

2. Premium Collection

Another way chatbots are influencing insurtech is by streamlining premium collection and policy renewals. Where agents used to have to coordinate with clients to find the right type and frequency of premium collection and then meet with them again every year for renewal, now chatbots can take over that job.

The chatbot can coordinate with the client to assign a method of payment from its internal list of options. It can also help the client choose the best option for them and set up the payments, right there in the chat window! Talk about convenience.

3. Lead Generation

This is one of the most powerful marketing uses of chatbots in any industry, particularly sales industries like insurance. Chatbots can help companies generate, nurture and convert leads all on their own. When they speak to leads, they can educate them directly about their questions, get their information to add them to email campaigns and even send them exactly where they need to go to convert to customers.

This frees up your marketing team to focus on more high-level, targeted campaigns instead of managing every lead that comes through your pipeline. The end result: a more powerful marketing machine.

4. Sell Services

Your agents might not want to hear this, but chatbots can actually sell policies too. As they answer people’s questions and help them refine their interests, they can also pair them with the right policies and generate quotes. From there, they can walk people through the process of applying for a policy and actually make the sale.

This requires a pretty advanced version of a chatbot with top-of-the-line programming to ensure it’s considering all the intricacies of the insurance industry before awarding policies. However, if you can afford it, it can greatly increase your earning potential as a company.

5. Provide Account Support

No one logs into their insurance account frequently, which means there’s a high demand for account access and support services. However, assigning this to your customer service team can take them away from more complex issues with customers who really need their help. That’s why companies have started outsourcing this task to chatbots.

Chatbots can help customers gain access to their accounts by using a variety of information such as their policy number, social security number or via a secret passcode they created. They can also help them troubleshoot problems with their account like accessing certain documents or using features of the portal interface. This gives your customers the help they need while leaving your service team free to handle more complex issues.

Insurance is going digital. Automated chatbots are expanding companies’ capabilities and profit margins by taking on these critical roles of customer service.